Introduction and Current Market Scenario of the Automotive AG Glass Industry

The Automotive AG (Automotive Glazing) Glass industry includes the manufacture and supply of specialty glass used in automobiles, such as windshields, side windows, and rear windows. AG glass is distinguished by its increased durability, safety features, and visual appeal, which frequently incorporate sophisticated technologies such as acoustic insulation and UV protection. The rising need for lightweight materials to improve fuel efficiency, as well as the increased attention to vehicle safety standards, are driving market expansion. Furthermore, the rise of electric and self-driving vehicles, which necessitate new glazing solutions, fuels market growth. As consumer preferences shift toward high-performance automobiles, the market for automotive AG glass grows.

Cognitive Market Research noticed that the demand for Automotive AG Glass in a variety of industries, including autonomous vehicles, electric vehicles, and commercial vehicles, is the primary driver of significant growth in the global Automotive AG Glass market. The Automotive AG Glass market was estimated to be worth approximately USD 24159.2 million in 2024 and is projected to increase to USD 38506.0944 million by 2032, with a compound annual growth rate (CAGR) of 6.0% during the forecast period, according to a recent market analysis. AGC, an internationally recognized producer of glass, chemicals, and high-tech materials for mobility, will return to CES in 2024. In the ever-changing mobility market, the business will showcase over 20 sophisticated technologies to improve connectivity, sensor integration, and passenger comfort. The company will highlight innovative, on-glass integrated solutions that reflect market trends.

What are the current trends of the Automotive AG Glass Market?

Based on the research conducted by Cognitive Market Research, the global Automotive AG Glass market is estimated to be worth approximately USD 24159.2 million as of 2023. This market size is indicative of a strong demand in a variety of sectors, with a particular emphasis on autonomous vehicles, electric vehicles, and commercial vehicles. The market value has been substantially influenced by the growing use of AG glass in the automotive industry. The market is anticipated to expand at a compound annual growth rate (CAGR) of 6.0%, with a market value of approximately USD 38506.0944 million by the conclusion of 2032. Increased disposable income and global population growth have bolstered automotive manufacturing and sales. These main drivers are propelling the automotive glass industry forward. Vehicle glass technology developments allow for cost and weight reductions while boosting driver comfort and safety.

North America accounted for approximately 35% of the total market in 2023, constituting the largest market share in the global Automotive AG Glass market. Early adoption of sophisticated glass glazing processes by a number of companies, including Magna International and Guardian Glass, is projected to boost market growth in this region. Europe follows with a 30% market share, primarily due to its strict automobile security standards, the presence of prominent innovators such as Saint-Gobain Sekurit, and the growing proportion of electric vehicles are all driving market growth in this region. The Asia-Pacific region is experiencing accelerated growth, with approximately 25% of the market held by countries such as China and India. Improved economic conditions and rapid population growth have resulted in increased car production. This feature has resulted in increasing demand for the product, and consumer preference for SUVs in China and India, which require more glass than other vehicles, is expected to boost market expansion in these countries. The Asia-Pacific market share is anticipated to increase to 32% by 2024, representing the highest CAGR among all regions, with a rate of 13%. The accelerated industrialization and the increasing adoption of AG glass in manufacturing and automotive are the driving forces behind this growth.

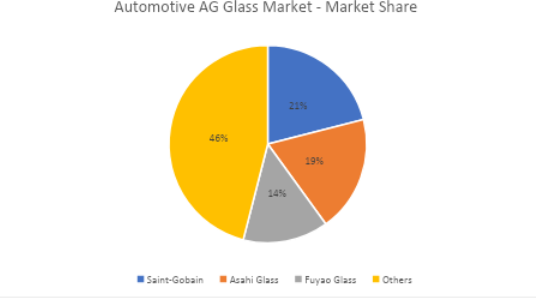

The Automotive AG Glass market is intensely competitive, with several prominent competitors monopolizing the landscape. Saint-Gobain, Asahi Glass, and Fuyao Glass are among the most significant organizations. Saint-Gobain maintained a dominant market share of approximately 21% in 2023, with Asahi Glass and Fuyao Glass following at 19% and 14%, respectively. These organizations are consistently investing in research and development to enhance and innovate their product offerings, thereby preserving their competitive advantage. Mergers, acquisitions, and strategic partnerships are also indicative of the competition, with the objective of broadening product portfolios and global reach. New entrants and increased competition are anticipated in the competitive landscape by 2024, with a particular emphasis on emerging markets in the Asia-Pacific region.

The increased popularity of electrified and self-driving automobiles is altering the automotive AG glass industry. These vehicles frequently demand innovative glazing solutions, such as lightweight glass, which helps to enhance overall energy efficiency and range. Smart glass, which can change opacity or contain displays, is gaining commercial traction as a solution to the inventive needs of modern vehicles. A burgeoning automotive sector in emerging economies is also fueling market expansion, as rising disposable income and shifting customer preferences drive demand for high-quality vehicles. The aftermarket industry is significant because an aging vehicle population opens up chances for replacement and repair services. Overall, the Automotive AG Glass market is poised for ongoing expansion, driven by technological advancements and growing consumer preferences for safety and comfort.

High costs and extensive capital investment will limit market growth.

High costs and large capital expenditure are important barriers to the expansion of the automotive AG (Automotive Glazing) glass market. Advanced automotive glazing needs significant investments in R&D and manufacturing facilities. This involves the use of advanced technologies like laminated and smart glass, which can be costly to manufacture. As a result, producers may face pressure to retain profitability while managing the high operational costs associated with these developments. Furthermore, the initial capital investment required to set up innovative production techniques may discourage smaller enterprises from entering the market. This lack of competition can stifle innovation and limit consumers' access to a wide range of product choices. Furthermore, the high prices of raw materials, especially specialist coatings, further contribute and make for manufacturing to offer products.

Another challenge is Supply chain interruptions are a major concern for the automotive AG (Automotive Glazing) glass business, affecting manufacturing deadlines, costs, and overall efficiency. The automobile glass business relies on a complicated supply chain for raw materials such as specialized glass, coatings, and adhesives. Disruptions in this supply chain can be caused by a variety of events, including geopolitical tensions, natural disasters, and worldwide pandemics, which can all have an impact on the availability of key resources. For example, changes in the supply of silica sand, a key component in glass manufacture, can cause production delays and higher costs. Furthermore, transportation constraints, such as port congestion or logistics challenges, might impede timely deliveries, limiting manufacturers' ability to meet customer demand. As vehicle production ramps up to meet rising consumer demand, it can result in significant delays.

Expected Future Developments in Automotive AG Glass Market.

Technological breakthroughs, sustainability initiatives, and changing consumer tastes are projected to affect the future of the automotive AG (Automotive Glazing) glass industry. One major development is the growing use of smart glass technologies, which enable functions such as changing tinting and built-in displays. These advancements increase the driving pleasure and energy economy, especially in electric vehicles. Furthermore, as manufacturers seek to reduce vehicle weight and improve fuel efficiency, there will be an increase in demand for lightweight glazing options. Advanced composite materials and thinner glass alternatives will become more common, boosting total vehicle performance. Sustainability will also play an important part in future advancements. Manufacturers are likely to focus on environmentally friendly manufacturing methods and materials, including the usage of low-emission coatings.

For example, The NSG Group merged its automotive glass business in China with SYP Kangqiao Autoglass Co., Ltd. ("SYP Automotive"), a well-known Chinese automotive glass maker. This merging with SYP Automotive increased NSG Group's ability to meet the growing demands of Chinese vehicle makers. The development of self-driving vehicles will increase demand for specialist glass solutions that can handle modern sensor systems and improve safety features. As the industry evolves, automotive AG glass makers must remain nimble, embracing innovation and sustainability in order to meet shifting market and consumer demands. Overall, these upcoming advances will set the automotive AG glass industry up for rapid growth and technological advancement.

Conclusion

At this juncture, the automotive AG (Automotive Glazing) glass industry is positioned for long-term expansion and transformation, fueled by technical advancements, environmental concerns, and increasing consumer tastes. As the automobile industry moves towards electrified, self-driving, and lightweight vehicle designs, the demand for high-performance glass solutions grows. Automotive AG glass is vital to improving vehicle safety, comfort, and efficiency, all of which are high goals for both current consumers and manufacturers. One of the primary drivers of this market is the growing use of smart glass technologies, which include automatic tinting, improved thermal management, and the capacity to support heads-up displays for augmented reality navigation. These advancements address the increased demand for convenience, comfort, and improved driving experiences, particularly in electric and autonomous vehicles. Lightweight glazing technologies are another critical component of the future of the automotive AG glass market. With strict environmental rules and a global push for sustainability, automakers are focusing on reducing vehicle weight to increase fuel efficiency and cut emissions. AG glass, with its ability to create thinner yet stronger shapes, is critical to accomplishing these aims.

Furthermore, the increasing emphasis on sustainability in the automotive industry is projected to have an impact on the materials and techniques used in AG glass production. Recyclable materials, eco-friendly coatings, and energy-efficient manufacturing techniques will become more common to meet customer and regulatory demands for greener products. However, difficulties such as high production costs, supply chain interruptions, and the difficulty of integrating new technologies must be addressed for this market. In general, the future of the automotive AG glass industry appears promising, with innovation creating new opportunities and growth. Companies that can handle these changes while meeting the changing needs of the automotive sector will thrive in this dynamic, competitive environment.

Author's Detail:

Kalyani Raje /

LinkedIn

With a work experience of over 10+ years in the market research and strategy development. I have worked with diverse industries, including FMCG, IT, Telecom, Automotive, Electronics and many others. I also work closely with other departments such as sales, product development, and marketing to understand customer needs and preferences, and develop strategies to meet those needs.

I am committed to staying ahead in the rapidly evolving field of research and analysis. This involves regularly attending conferences, participating in webinars, and pursuing additional certifications to enhance my skill set. I played a crucial role in conducting market research and competitive analysis. I have a proven track record of distilling complex datasets into clear, concise reports that have guided key business initiatives. Collaborating closely with multidisciplinary teams, I contributed to the development of innovative solutions grounded in thorough research and analysis.