Introduction and Current Market Scenario of the Biopolymers Industry

The biopolymers market has gained significant traction in recent years as global demand for sustainable and eco-friendly materials has grown. Biopolymers, derived from renewable sources such as plants, animals, and microorganisms, offer an attractive alternative to conventional petroleum-based polymers due to their biodegradability, lower environmental impact, and renewable origin. The global market for biopolymers is being driven by the rising awareness of environmental concerns, stringent regulations on plastic waste, and growing consumer demand for greener products.

Cognitive Market Research noticed that biopolymers are used in a variety of applications across multiple industries, including packaging, automotive, agriculture, textiles, and healthcare. In the packaging sector, biopolymers are particularly appealing due to their biodegradable nature, helping reduce plastic pollution and waste. The biopolymer market was estimated to be worth approximately USD 18245.5 million in 2024 and is projected to increase to USD 40850.4 million by 2032, with a compound annual growth rate (CAGR) of 10.60% during the forecast period, according to a recent market analysis. Additionally, biopolymers are increasingly being utilized in medical applications such as drug delivery systems, wound dressings, and sutures, given their biocompatibility and ability to degrade naturally in the human body.

What Are the Current Trends of the Biopolymers Market?

Based on the research conducted by Cognitive Market Research the global biopolymer market is estimated to be worth approximately USD 18245.5 million as of 2024. The biopolymers market is experiencing transformative trends that are significantly driving demand and shaping its evolution. A prominent trend is the increasing adoption of biopolymers in packaging, fueled by environmental concerns over plastic waste and the desire to reduce fossil fuel dependence. Biopolymers such as polylactic acid (PLA), polyhydroxyalkanoates (PHA), and starch-based polymers are being increasingly used as sustainable alternatives to conventional plastics in the production of bottles, food containers, and films. Similarly, the automotive industry is embracing biopolymers to support sustainability and lightweighting initiatives, integrating materials like natural fiber composites and bioplastics into components such as interior panels, dashboards, and seat fabrics. These advancements contribute to improved fuel efficiency and a reduced carbon footprint. Additionally, the healthcare sector is showing a growing interest in biopolymers for medical applications due to their biocompatibility and biodegradability. Applications in drug delivery systems, wound healing products, and implantable devices are becoming increasingly common, with biopolymers like chitosan and collagen gaining traction for their ability to support tissue regeneration and minimize infection risks. Furthermore, the development of smart biopolymers that respond to external stimuli such as temperature or pH underscores the sector's potential to revolutionize healthcare solutions.

Tthe biopolymers market is dominated by North America, holding over 35% of the global market share, driven by innovation, advanced technological developments, and stringent environmental regulations promoting biodegradable products. Europe follows with approximately 30% market share, supported by a robust regulatory framework, strong production capabilities in countries such as Germany and France, and EU initiatives targeting plastic waste reduction. Meanwhile, the Asia-Pacific region is experiencing rapid growth, projected to witness a CAGR of over 14% from 2024 to 2030, fueled by expanding manufacturing capabilities in China and India, rising consumer awareness about sustainability, and government policies encouraging green technologies.

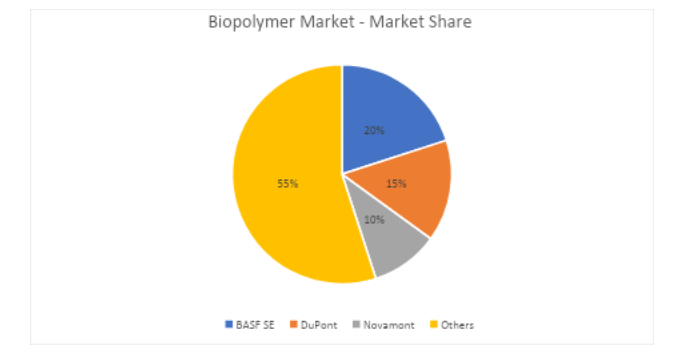

The biopolymer market is highly competitive, with several leading players dominating the industry. BASF SE, DuPont, and Novamont are among the most prominent organizations shaping the market landscape. BASF SE held a dominant market share of approximately 20% in 2023, followed by DuPont and Novamont with market shares of 15% and 10%, respectively. These companies are heavily investing in research and development to advance their biopolymer technologies and introduce innovative, eco-friendly solutions, ensuring their continued competitive edge. Strategic partnerships, mergers, and acquisitions are also prevalent in this market, aimed at expanding product portfolios and enhancing global reach. By 2024, the competitive landscape is expected to witness the entry of new players and intensified competition, particularly in emerging markets such as Asia-Pacific, where demand for sustainable materials is on the rise.

Biopolymers are increasingly preferred due to their sustainability and compatibility with environmentally conscious applications, making them a strong alternative to traditional synthetic polymers. Biopolymers hold a significant market share compared to conventional plastics and bio-based composites as of 2023. While traditional plastics dominate the global polymer market due to their cost-effectiveness and versatility, biopolymers are gaining traction for their biodegradability and reduced reliance on fossil fuels. Currently, biopolymers account for approximately 10% of the global polymer market, with bio-based composites and other sustainable materials collectively holding a 6% share. The biopolymer market share is projected to grow to 12% by 2024, driven by increasing demand in applications such as packaging, automotive components, and medical devices. This growth reflects a rising preference for biopolymers as industries and consumers seek eco-friendly solutions aligned with global sustainability goals.

The High Cost Associated with Biopolymers to Restrain Market Growth

While the biopolymers market is gaining momentum due to rising environmental concerns and demand for sustainable materials, the high cost of production remains a significant constraint. The manufacturing of biopolymers, particularly through advanced synthesis techniques like microbial fermentation and enzyme catalysis, often requires expensive feedstocks and specialized equipment. This increases the overall cost compared to conventional polymers derived from petroleum-based sources. For example, polylactic acid (PLA), a commonly used biopolymer, can cost up to USD 3 to USD 4 per kilogram, which is significantly higher than traditional plastics such as polyethylene, priced at approximately USD 1 to USD 2 per kilogram. Such cost disparities hinder the broader adoption of biopolymers, particularly in price-sensitive industries like packaging and consumer goods.

Additionally, the production of biopolymers involves complexities such as maintaining controlled fermentation conditions and ensuring consistent polymer quality, which can escalate operational expenses. The need for advanced purification and polymerization processes further contributes to high costs. For instance, the production of polyhydroxyalkanoates (PHA) requires not only a suitable microbial strain but also precise nutrient formulations and temperature management, making it one of the most expensive biopolymers on the market. Despite its environmental benefits, PHA adoption remains limited, with many companies hesitant to integrate it into their production lines due to the associated costs.

Moreover, the high production costs of biopolymers can translate into elevated product prices for end-users, making them less competitive against conventional materials in many applications. This price barrier is particularly evident in regions with less stringent environmental regulations or where cost efficiency is prioritized over sustainability. For instance, small and medium-sized enterprises often find it financially unviable to switch to biopolymers, despite their eco-friendly appeal. As a result, the market’s growth potential is restrained, particularly in emerging economies that lack robust policy frameworks or subsidies to offset costs. Addressing these cost-related challenges will be crucial for unlocking the full potential of the biopolymers market.

Expected Future Developments in the Biopolymers Market

The biopolymer market is poised for significant growth driven by continuous technological innovations that aim to improve sustainability and production efficiency. The future of biopolymers lies in the development of advanced production techniques, including microbial fermentation and enzyme catalysis, which are enhancing the performance and versatility of biopolymer materials. These advancements are helping to meet the growing demand for eco-friendly alternatives in industries like packaging, automotive, and healthcare. For instance, in December 2023, Sulzer launched a new biodegradable polymer for bioplastics, aimed at enhancing the production of sustainable materials with a reduced environmental impact. This innovation holds considerable significance for the biopolymer market as it offers a solution to the rising global demand for sustainable packaging, promoting the transition from conventional plastics to more environmentally-friendly alternatives.

As biopolymer production techniques continue to evolve, the focus will shift towards improving the scalability and cost-effectiveness of manufacturing processes. The market will likely see an increase in the availability of biopolymer products with superior performance characteristics, such as enhanced biodegradability, better thermal stability, and broader application in food packaging, automotive components, and medical devices. This progression is expected to open new avenues for biopolymers to replace traditional materials across a wider range of industries. Furthermore, regulatory support and growing consumer preference for sustainable products will continue to drive investment in biopolymer research and development. By leveraging breakthroughs in materials science and production technology, the biopolymer market is set to play a crucial role in reducing global plastic waste and fostering a more sustainable future.

Conclusion

The biopolymers market is on a robust growth trajectory, fueled by the increasing demand for sustainable materials across diverse industries. As the world grapples with environmental challenges such as plastic pollution and climate change, biopolymers are emerging as a critical solution due to their renewable origin, biodegradability, and reduced reliance on fossil fuels. Advancements in production techniques, including microbial fermentation and enzyme catalysis, have significantly enhanced the performance and versatility of biopolymers, making them suitable for applications ranging from packaging to healthcare. Industries such as automotive and packaging are driving this demand by incorporating biopolymers into lightweight components and eco-friendly packaging materials, respectively. Healthcare has also embraced biopolymers for innovations in drug delivery systems and biocompatible surgical materials, showcasing their adaptability and transformative potential.

Despite these opportunities, challenges such as high production costs and scalability remain critical barriers to the widespread adoption of biopolymers. To overcome these hurdles, stakeholders must invest in research and development to optimize manufacturing processes, reduce costs, and expand the range of biopolymer products. Collaboration between governments, industries, and research institutions is equally vital to foster supportive regulatory frameworks and financial incentives that encourage the transition to biopolymers. Companies focusing on cost-efficient innovation and strategic partnerships will be well-positioned to capitalize on the growing market. As global awareness of sustainability increases, the biopolymers market will not only support environmental goals but also play a pivotal role in shaping a sustainable materials economy for future generations.

Author's Detail:

Kalyani Raje /

LinkedIn

With a work experience of over 10+ years in the market research and strategy development. I have worked with diverse industries, including FMCG, IT, Telecom, Automotive, Electronics and many others. I also work closely with other departments such as sales, product development, and marketing to understand customer needs and preferences, and develop strategies to meet those needs.

I am committed to staying ahead in the rapidly evolving field of research and analysis. This involves regularly attending conferences, participating in webinars, and pursuing additional certifications to enhance my skill set. I played a crucial role in conducting market research and competitive analysis. I have a proven track record of distilling complex datasets into clear, concise reports that have guided key business initiatives. Collaborating closely with multidisciplinary teams, I contributed to the development of innovative solutions grounded in thorough research and analysis.