Introduction and Current Market Scenario of the Blood Collection Industry

The blood collection market is a cornerstone of the healthcare system, providing essential tools and methodologies for diagnostics, transfusions, and therapeutic applications. Blood collection encompasses a range of processes, including venipuncture, fingerstick sampling, and arterial sampling, all of which are critical for analyzing and diagnosing various medical conditions. The industry is expanding rapidly, driven by the growing demand for blood and blood components for surgeries, trauma care, and chronic disease management.

In recent years, advancements in medical technology have significantly improved the efficiency, safety, and accuracy of blood collection methods. Innovations such as automated blood collection devices and closed blood collection systems have minimized contamination risks, enhanced patient comfort, and optimized workflow for healthcare providers. Furthermore, the rising prevalence of chronic diseases like cancer, diabetes, and cardiovascular disorders is increasing the demand for routine blood tests, further propelling market growth.

The blood collection market was estimated to be worth approximately USD 3914.5 million in 2024 and is projected to increase to USD 7742.8 million by 2032, with a compound annual growth rate (CAGR) of 8.90% during the forecast period, according to a recent market analysis. This growth is underpinned by factors such as the expansion of healthcare infrastructure in emerging economies, an aging population with increased healthcare needs, and the growing importance of preventive care. Additionally, rising awareness about blood donation and the establishment of advanced blood banks are contributing to the steady development of this market.

What Are the Current Trends of the Blood Collection Market?

The blood collection market is witnessing significant trends driven by advancements in minimally invasive and patient-centric techniques, such as microfluidic devices for capillary blood collection, which offer less discomfort and are particularly beneficial for pediatric and geriatric patients. The integration of digital health technologies, including wearable devices for continuous blood monitoring, is enhancing real-time analysis and reducing the need for frequent blood draws. Automation in blood collection is also on the rise, with automated devices improving sample quality, reducing human error, and increasing efficiency in hospitals and diagnostic labs. Furthermore, the growing adoption of closed-loop systems ensures sample integrity and prevents contamination, meeting stringent regulatory standards. Increased awareness of the importance of blood donation and voluntary donation campaigns is further contributing to the market's growth, addressing blood shortages and enhancing the efficiency of the blood collection process.

North America leads the global blood collection market, holding over 40% of the market share, due to its well-established healthcare infrastructure, high adoption of advanced blood collection technologies, and a robust system of blood banks and diagnostic laboratories, particularly in the United States. Europe follows closely with approximately 30% of the market share, driven by a strong focus on healthcare innovation, favorable government policies promoting blood donation, and widespread use of advanced diagnostic tools, with countries such as Germany, the UK, and France playing key roles. The Asia-Pacific region is emerging as a high-growth market, projected to grow at a CAGR of 8% from 2024 to 2032, fueled by the rising prevalence of chronic diseases, increasing healthcare expenditure, expanding awareness about blood donation, and the growth of diagnostic laboratories in countries like China, India, and Japan.

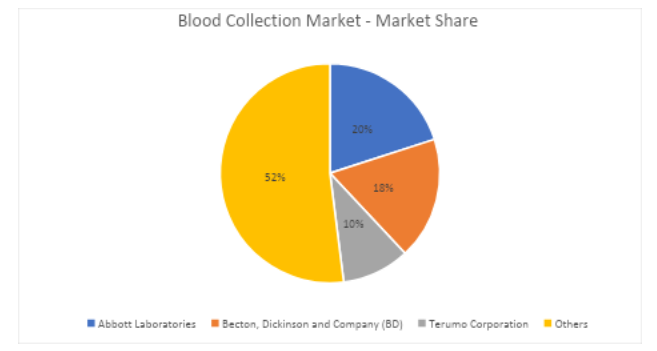

The blood collection market is highly competitive, with several major players leading the market. Abbott Laboratories holds a dominant market share of approximately 20% in 2024, followed by Becton, Dickinson and Company (BD) with an 18% share, and Terumo Corporation at 10%. These companies continue to invest heavily in research and development to enhance their product offerings, improve blood collection efficiency, and integrate advanced technologies such as automation and digital health. Strategic mergers, acquisitions, and partnerships are also common in the market as these companies aim to expand their product portfolios and strengthen their global presence. As demand for blood collection devices rises across various regions, new entrants are expected to intensify competition, especially in emerging markets within the Asia-Pacific region, where healthcare infrastructure and awareness are rapidly improving.

Blood collection products are increasingly preferred across healthcare sectors due to their ability to enhance patient comfort, reduce the risk of contamination, and improve operational efficiency. Compared to traditional venipuncture methods, newer blood collection technologies, such as capillary collection devices and automated systems, offer more precision and convenience, making them ideal for applications in diagnostics, emergency care, and routine blood draws. As of 2024, blood collection products hold approximately 40% of the overall medical consumables market, with diagnostic kits and syringes capturing 30% and 25%, respectively. The market share of blood collection products is expected to increase slightly to 42% by 2025, driven by the rising demand for minimally invasive collection techniques, advancements in automation, and growing emphasis on patient-centric care. This trend underscores the increasing preference for blood collection systems that offer both efficiency and reduced patient discomfort, especially in pediatric and geriatric populations.

Regulatory Hurdles Hindering the Growth of the Blood Collection Market

The blood collection market is significantly impacted by regulatory hurdles, which can hinder its growth and development. Stringent regulations and compliance requirements imposed by government bodies such as the FDA, European Medicines Agency (EMA), and other national regulatory agencies ensure the safety and quality of blood collection products. These regulations often require extensive clinical testing, approval processes, and quality control measures before new blood collection technologies can be introduced to the market. For example, medical devices related to blood collection must meet rigorous standards for sterility, precision, and safety to prevent contamination or injury during collection procedures.

Additionally, manufacturers must adhere to specific labeling, packaging, and storage requirements, which can lead to higher production costs and longer time-to-market for new products. The complexity of regulatory approval processes is especially challenging for companies seeking to expand into new geographic regions, where different countries may have varying requirements. This disparity in regulatory frameworks can delay product launches and limit market access for blood collection solutions, particularly in emerging markets where demand is rising.

The increasing emphasis on patient safety and compliance with health and safety standards can also lead to increased scrutiny of manufacturing processes, leading to potential delays in product availability. Furthermore, regulatory compliance can require additional investments in documentation, certifications, and ongoing audits, adding to the operational costs for manufacturers. These factors combined create barriers for market players, particularly smaller companies, limiting their ability to innovate and expand.

Expected Future Developments in the Blood Collection Market

The blood collection market is poised for significant advancements, with innovations aimed at improving both patient experience and diagnostic efficiency. One such instance is the launch of the BD Vacutainer UltraTouch Push Button Blood Collection Set by BD India in April 2024. This device leverages advanced technologies, including BD RightGauge and BD PentaPoint, to ensure a thinner needle and reduce insertion pain. This innovation addresses a key concern in blood collection patient discomfort by enabling a single-prick success and decreasing needle-related injuries by up to 88%. As a result, it aims to significantly enhance patient satisfaction during blood collection procedures, aligning with the broader industry shift toward patient-centric care.

Furthermore, the market is seeing growth in wearable blood collection devices that enable continuous or periodic blood sampling without invasive procedures. These devices are expected to revolutionize chronic disease management and clinical research by providing real-time data for personalized treatment plans. Similarly, the integration of smart blood collection systems with digital health platforms and IoT technology is improving the transparency and efficiency of diagnostic workflows. These developments, along with the incorporation of blockchain for secure and traceable blood collection processes, demonstrate the market’s commitment to addressing evolving healthcare needs.

Additionally, the blood collection industry is witnessing the use of advanced materials such as bioactive coatings for needles and tubes, which aim to reduce patient discomfort and prevent sample contamination. The increasing focus on environmentally sustainable practices, including biodegradable materials and the reduction of single-use plastics, also highlights the industry's push toward greater environmental responsibility. Collectively, these innovations position the blood collection market for continued growth, offering improved solutions for both patients and healthcare providers.

Conclusion

The blood collection market is experiencing rapid growth due to a convergence of several key factors. Technological advancements are playing a pivotal role in driving this expansion. Automation and artificial intelligence (AI) are being integrated into blood collection processes, improving both the accuracy and efficiency of sample collection, reducing human error, and enabling faster processing times. This is particularly valuable in clinical settings where high throughput and precise results are critical. Additionally, the emergence of liquid biopsy technologies—non-invasive methods to detect diseases through blood samples offers new opportunities in diagnostics and personalized medicine, further propelling the market's growth.

Rising healthcare demands are also fueling the market. As populations age and the prevalence of chronic diseases increases, the need for routine blood tests and diagnostic procedures is expanding. At the same time, the growing focus on patient-centric care, which prioritizes comfort and convenience, has prompted innovations in blood collection methods, such as minimally invasive techniques and wearable devices for continuous blood monitoring. These solutions not only enhance patient comfort but also improve compliance and reduce the need for frequent visits to healthcare facilities. As the market continues to innovate and address unmet medical needs, its role as a critical healthcare component is expected to strengthen, contributing to its continued expansion.

Author's Detail:

Kalyani Raje /

LinkedIn

With a work experience of over 10+ years in the market research and strategy development. I have worked with diverse industries, including FMCG, IT, Telecom, Automotive, Electronics and many others. I also work closely with other departments such as sales, product development, and marketing to understand customer needs and preferences, and develop strategies to meet those needs.

I am committed to staying ahead in the rapidly evolving field of research and analysis. This involves regularly attending conferences, participating in webinars, and pursuing additional certifications to enhance my skill set. I played a crucial role in conducting market research and competitive analysis. I have a proven track record of distilling complex datasets into clear, concise reports that have guided key business initiatives. Collaborating closely with multidisciplinary teams, I contributed to the development of innovative solutions grounded in thorough research and analysis.