What are the Current Trends in the Logistics Real Estate Market?

The logistics real estate market, estimated to be worth USD 102,611.6 million in 2024, is experiencing robust growth due to shifting consumer behaviors and technological advancements. With a projected CAGR of 6.2%, the market is expected to reach USD 166,032.3 million by 2032. This growth is primarily driven by the increasing dominance of e-commerce, which now constitutes a significant portion of global retail sales. The demand for warehouses equipped with advanced technologies, such as automated storage and retrieval systems (AS/RS), is reshaping the logistics real estate landscape. Additionally, the adoption of sustainable and green building practices is gaining traction as companies strive to meet environmental regulations and reduce their carbon footprint.

North America accounts for the largest market share, holding approximately 40% in 2024. This dominance is attributed to the region's mature e-commerce market, robust infrastructure, and strategic investments in logistics facilities. Europe follows closely, representing 30% of the market, with key contributions from countries like Germany and the Netherlands, which serve as logistics hubs for the continent. The Asia-Pacific region is witnessing the fastest growth, accounting for 20% of the market in 2024, with an anticipated increase to 24% by 2026. Rapid urbanization, expanding middle-class populations, and the boom in e-commerce in countries like China and India are propelling this growth. Furthermore, initiatives such as China's Belt and Road Initiative are driving infrastructure development, enhancing connectivity, and boosting demand for logistics real estate across the region.

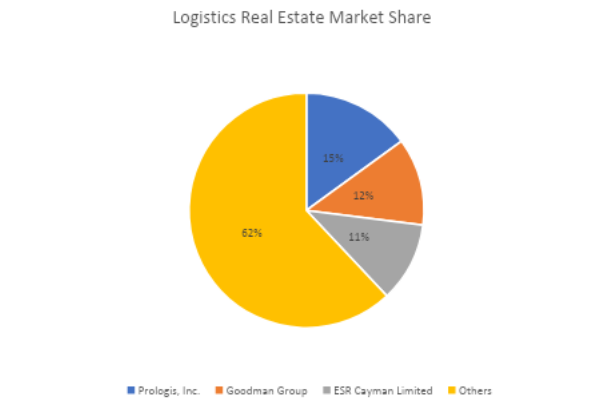

The logistics real estate market is highly competitive, with several leading players commanding significant portions of the market. Prologis, Inc., Goodman Group, and ESR Cayman Limited are among the top competitors shaping the industry landscape. Prologis, Inc. maintained a dominant market share of approximately 15% in 2024, followed by Goodman Group and ESR Cayman Limited with 12% and 11%, respectively. These companies have consistently focused on strategic investments in technology-driven facilities, sustainable infrastructure, and high-demand regions to solidify their market positions. The competitive landscape is further defined by mergers, acquisitions, and joint ventures aimed at expanding global reach and diversifying portfolios. The entry of new players, especially in high-growth regions like Asia-Pacific, is expected to intensify competition by 2025, with a focus on last-mile logistics solutions and urban warehousing.

Logistics real estate is increasingly preferred for its role in optimizing supply chain efficiency compared to conventional industrial real estate. While traditional warehouses and industrial facilities remain important, logistics-specific properties are gaining traction due to their design tailored for e-commerce, automation, and advanced inventory management systems. As of 2024, logistics-specific real estate accounted for approximately 45% of the total industrial real estate market, with traditional facilities at 35% and mixed-use industrial spaces at 20%. This share is expected to rise to 48% by 2025, driven by the growing demand for last-mile delivery hubs and technology-integrated facilities. This comparative advantage highlights the increasing preference for logistics-specific properties, especially in regions where rapid urbanization and e-commerce growth are shaping market demands.

Rising Cost of Land and Construction Materials Hinders the Logistics Real Estate Market Growth

Despite the promising opportunities in the logistics real estate market, the sector faces several challenges that could hinder its growth. A primary constraint is the rising cost of land and construction materials, which is significantly impacting the affordability of logistics facilities, particularly in urban areas. As the demand for strategically located properties near city centers increases, so does competition among developers, driving up property prices and making it challenging for smaller players to compete. For instance, data from recent market reports indicate that land prices in prime logistics hubs have risen by nearly 15% in the past two years, adding substantial financial pressure on developers and tenants alike. Additionally, the logistics real estate sector is grappling with labor shortages, particularly in regions with high demand for skilled workers to operate advanced automated systems. The lack of adequately trained personnel to manage sophisticated technologies such as robotics and AI-driven warehouse management systems is causing delays in the adoption of these innovations, thereby limiting operational efficiency.

Another significant challenge is the growing emphasis on sustainability, which, while presenting opportunities, also adds complexity and cost to logistics facility development. Achieving compliance with stringent environmental regulations often requires substantial investments in green technologies, such as energy-efficient building materials and renewable energy systems, which can inflate project costs. Moreover, the integration of these sustainable solutions often requires extensive retrofitting of older facilities, further adding to the financial burden. Additionally, the logistics real estate market is heavily influenced by macroeconomic factors, such as fluctuations in interest rates and geopolitical tensions, which can disrupt global supply chains and impact investment decisions. The uncertainty surrounding trade policies and economic stability in key markets has led to delays in large-scale logistics projects, dampening growth prospects. For example, recent disruptions in global supply chains due to geopolitical conflicts have highlighted the vulnerability of logistics networks to external shocks, underscoring the need for resilient and adaptive infrastructure to mitigate these risks.

Expected Future Developments in the Logistics Real Estate Market

The logistics real estate market is expected to undergo significant advancements in the coming years, driven by technological innovation, evolving consumer demands, and a heightened focus on sustainability. The integration of advanced technologies, such as AI-powered predictive analytics and blockchain, is set to revolutionize supply chain management and logistics facility operations. Predictive analytics is enabling businesses to forecast demand patterns with greater accuracy, optimize inventory management, and reduce waste, while blockchain technology is enhancing transparency and security in supply chain transactions. These technologies are not only improving efficiency but are also fostering trust and collaboration among stakeholders in the logistics ecosystem. For instance, the adoption of blockchain for tracking and verifying shipments is streamlining customs processes and reducing delays, thereby enhancing the overall efficiency of international trade.

Moreover, the rise of urbanization and the growing emphasis on last-mile delivery solutions are expected to drive the development of multi-story logistics facilities in densely populated areas. These vertical warehouses are designed to maximize space utilization in land-constrained urban centers, providing a practical solution to the challenges posed by limited land availability. Advanced material handling systems, such as automated storage and retrieval systems (AS/RS), are being integrated into these facilities to enhance operational efficiency and accommodate the increasing volume of e-commerce shipments. Sustainability will also remain a central focus in the future development of logistics real estate. Developers are expected to adopt innovative construction techniques, such as prefabrication and modular construction, to reduce waste and accelerate project timelines. Additionally, the incorporation of renewable energy solutions, such as rooftop solar panels and energy storage systems, is anticipated to become standard practice, aligning with global efforts to combat climate change.

Conclusion

The logistics real estate market is at a critical juncture, characterized by transformative technological advancements, evolving consumer demands, and a growing emphasis on sustainability. To capitalize on the opportunities presented by this dynamic market, developers and stakeholders must prioritize investments in smart technologies and sustainable solutions. The integration of IoT-enabled systems, robotics, and AI in logistics facilities is not only enhancing operational efficiency but is also meeting the growing demand for rapid and reliable delivery services.

Simultaneously, adopting green building practices and renewable energy solutions is essential to address environmental concerns and regulatory requirements, while also delivering long-term cost savings. However, addressing the challenges posed by rising land costs, labor shortages, and macroeconomic uncertainties will require strategic planning and collaboration among industry stakeholders. By leveraging innovative construction techniques and exploring alternative financing models, the logistics real estate market can overcome these barriers and unlock its full potential. As the sector continues to evolve, the focus on resilience, adaptability, and sustainability will be crucial in shaping its future trajectory, ensuring that it remains a cornerstone of the global supply chain.

Author's Detail:

Anushka Gore /

LinkedIn

Anushka Gore is a seasoned market researcher specializing in the dynamic landscape of the medical devices & consumables industry. She has dedicated herself unraveling the intricate market trends and consumer behaviors that shape the future of medical technologies and services. Her expertise in Market Research and business intelligence has equipped her with the skills necessary to analyze complex information and provide strategic recommendations.

In her current role, Anushka is a highly motivated and detail-oriented research analyst with a passion for uncovering valuable insights from data. She thrives in dynamic environments where her analytical abilities and research expertise can contribute to informed decision-making for businesses. Her collaborative approach facilitated effective communication of insights, fostering a data-driven culture within the organization.Anushka remains an invaluable asset in the dynamic landscape of market research.