Introduction and Current Market Scenario of the Activated Carbon Fiber Industry

Activated carbon fiber (ACF) is a highly porous material that is produced from organic precursors, including phenolic resin, polyacrylonitrile (PAN), and cellulose. ACF is a critical material in a variety of advanced applications due to its exceptional adsorption capabilities, which are characterized by its micro-porosity and extraordinarily high surface area. ACF is particularly advantageous for applications that necessitate high efficiency and rapid adsorption, as it provides a more uniform pore structure and a higher adsorption rate in contrast to granulated or powdered activated carbon. The ACF market is experiencing substantial growth in 2023 and 2024, which is being driven by its widespread applications in a variety of industries. ACF's high adsorption capacity and chemical stability render it highly effective in the removal of volatile organic compounds (VOCs), heavy metals, and other pollutants in air and water purification. The chemical industry has widely adopted the material for solvent recovery and gas separation processes due to its capacity to adsorb gases at low concentrations. Furthermore, the increasing popularity of electric vehicles (EVs) has resulted in an increased demand for ACF in battery electrodes and supercapacitors. The increased energy storage capabilities of ACF are a result of its large surface area and electrical conductivity.

Cognitive Market Research noticed that the demand within the healthcare sector, particularly in protective masks and filters, was the primary driver of the global demand for ACF in 2023. This is because its capacity to capture airborne pathogens and pollutants is essential. The market is anticipated to continue expanding in 2024, as the adoption of ACF in carbon capture and storage (CCS) technologies is driven by a growing emphasis on environmental sustainability. The material's potential in these emerging applications underscores its increasing significance in addressing global environmental challenges, establishing ACF as a critical component in the ongoing transition to a more sustainable, cleaner future. This robust expansion is anticipated to persist as industries progressively acknowledge ACF's exceptional performance characteristics and capacity to satisfy rigorous regulatory requirements. In March 2022, Toyobo Co. Ltd and Mitsubishi Corporation executed an agreement to establish a new joint venture company (Toyobo Co. Ltd, 51%, and Mitsubishi Corporation, 49%). The company is anticipated to commence operations in January 2023 and is dedicated to the planning, development, manufacturing, and sales of functional materials.

What are the current trends in the Activated Carbon Fiber Market?

Based on the research conducted by Cognitive Market Research the global Activated Carbon Fiber (AOM) market is estimated to be worth approximately USD 359.2 million as of 2024 and will grow at a CAGR of 9.8% for the upcoming years. The integration of ACF into environmental preservation and sustainability initiatives is one of the most significant trends in 2023. The material's exceptional adsorption capabilities render it the optimal choice for air and water purification systems, thereby addressing the increasing demand for cleaner environments in the context of industrialization and urbanization. Furthermore, the healthcare sector has experienced a significant increase in demand for ACF because of its use in personal protective equipment, including masks and filters, which are crucial for protecting against airborne pathogens. Another substantial trend is the growing utilization of ACF in energy storage technologies. The demand for advanced materials that improve the efficacy and performance of energy storage devices is on the rise because of the rapid adoption of renewable energy systems and electric vehicles (EVs). ACF, which is being extensively researched and employed in supercapacitors and battery electrodes due to its high surface area and conductivity, is making a significant contribution to the development of more efficient energy storage solutions.

The global ACF market is highly segmented, with substantial regional variations in demand and application. The global ACF market is primarily driven by the following regions: North America, Asia-Pacific, Europe, and the Rest of the World. As of 2023, Asia-Pacific accounts for approximately 40% of global demand, comprising the highest market share. The region's rapid industrialization, in conjunction with the escalating environmental regulations in countries such as China, Japan, and South Korea, is the reason for this dominance. North America closely follows, accounting for approximately 30% of the global market. The region's substantial share is a result of its substantial investments in sophisticated energy storage solutions and its strong emphasis on environmental protection. The market in this region is further supported by the presence of significant players in the U.S. and Canada, as well as stringent regulatory frameworks. With a strong emphasis on sustainable technologies and a growing demand for ACF in automotive and industrial applications, Europe accounts for approximately 20% of the market. The remaining 10% of the market is held by the Rest of the World, which encompasses regions such as Africa, the Middle East, and Latin America. These regions are still emerging markets for ACF; however, they are experiencing a rise in adoption as a result of urbanization, industrialization, and a heightened sense of environmental awareness.

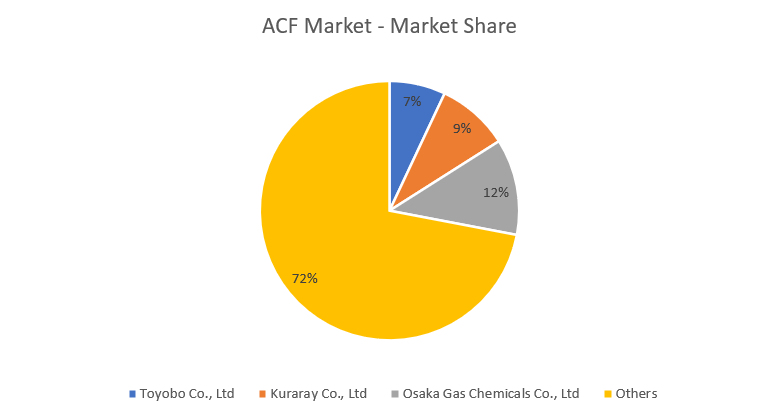

Several key players dominate the ACF market, owing to their strategic market positioning, advanced manufacturing capabilities, and extensive product portfolios, which have garnered substantial market shares. In the global ACF market, Toyobo Co., Ltd., Kuraray Co., Ltd., and Osaka Gas Chemicals Co., Ltd. are among the leading participants. The significant presence and influence of these companies in the industry are reflected in their collective ownership of approximately 50% of the global market share. Toyobo Co., Ltd., a prominent participant in the industry, which held a market share of 7%, is committed to enhancing production efficiency and broadening its product line through ongoing innovation. The company's strategy involves investing in research and development to enhance the performance characteristics of ACF, thereby enabling it to be used in a broader array of applications. In addition, Kuraray Co, Ltd. Held a market share of 9% of the total market. With a robust market presence in both North America and the Asia-Pacific region, Osaka Gas Chemicals Co., Ltd held a market share of 12% is recognized for its exceptional ACF products. The organization's approach entails the utilization of its extensive distribution network and the extension of its application areas, with a particular emphasis on environmental protection and energy storage.

Technological Trends and Advancements in Activated Carbon Fiber Market?

The incorporation of nanotechnology into the production processes of the activated carbon fiber (ACF) market is one of the most significant technological trends. By manipulating materials at the atomic and molecular levels, nanotechnology improves the adsorption and surface area of ACF. This method enables the development of ACF with ultra-fine pore structures, resulting in a substantial enhancement of efficacy in applications such as gas adsorption, energy storage, and air and water purification. Nano-ACF development is particularly promising for sophisticated filtration systems, which require the capacity to capture and eliminate contaminants at a molecular level. Additionally, nano-ACF is being investigated for its potential in medical applications, such as drug delivery systems and biosensors, where precision and efficiency are critical. It is anticipated that the ongoing research and development in nanotechnology will result in further advancements in ACF, rendering it an even more versatile and effective material for a variety of high-tech applications.

The ACF market is experiencing a substantial trend in the Asia-Pacific region, where it is increasingly being utilized in environmental protection, particularly in air and water purification systems. The region, which comprises approximately 40% of the global ACF market, has experienced a significant increase in demand because of accelerated industrialization and the escalating environmental regulations. For example, the deployment of ACF in pollution control technologies has increased because of the strict emissions standards that have been implemented in China and Japan. China alone accounted for nearly 25% of the global ACF consumption in 2023, which is indicative of the country's emphasis on the reduction of industrial pollution. The Japanese market is renowned for its sophisticated environmental technologies, has also experienced significant growth, notably in the implementation of ACF for the removal of volatile organic compounds (VOCs) and water treatment. Additionally, governments in the region are expanding their investments in technologies that mitigate carbon emissions, with ACF serving as a critical component of carbon capture and storage (CCS) initiatives. It is anticipated that the demand for ACF in the Asia-Pacific region will continue to be driven by a combination of governmental regulations, industrial development, and the push towards sustainable practices, thereby solidifying its status as a leader in environmental protection applications.

Development of Advanced Energy Storage Systems to Emerge as one of the key Opportunities for the Activated Carbon Fiber Market

The development of advanced energy storage systems, primarily using ACF in supercapacitors, is one of the most promising opportunities in the activated carbon fiber (ACF) market. Ultracapacitors, also referred to as supercapacitors, are energy storage devices that are well-suited for use in electric vehicles (EVs), renewable energy systems, and portable electronics. They are characterized by their extended operational life, rapid charge and discharge cycles, and high-power density. The integration of ACF in supercapacitors is a highly technical opportunity that has the potential to substantially improve the performance of these devices, resulting in increased market adoption and growth. ACF is an optimal material for supercapacitor electrodes due to its exceptional electrical conductivity, uniform pore distribution, and high surface area. The energy density of the supercapacitor is directly influenced by the high surface area of ACF, which can exceed 2,500 m²/g, which enables a greater quantity of charge to be stored per unit volume. Furthermore, the uniform pore structure of ACF enables the rapid movement of ions within the electrode, thereby improving the device's overall power density and charge/discharge rates. This attribute is especially advantageous in applications that necessitate rapid energy delivery, such as in electric vehicles (EVs) during acceleration or regenerative deceleration.

The increasing demand for high-performance energy storage systems further exacerbates the opportunity for ACF in supercapacitors. This expansion is fueled by the growing utilization of supercapacitors in the automotive sector, where the transition to electric vehicles is expediting the need for energy storage solutions that are both reliable and efficient. By employing ACF in supercapacitors, the current constraints of energy density and cycle life can be overcome, thereby increasing their competitiveness with conventional batteries. The renewable energy industry presents a substantial opportunity for ACF-based supercapacitors, in addition to the automotive sector. The global movement toward cleaner energy sources have resulted in a growing demand for energy storage systems that are efficient and capable of stabilizing power infrastructures while also managing the intermittent nature of renewable energy sources such as solar and wind sources. ACF is an appropriate candidate for grid-scale energy storage applications due to its capacity to provide rapid response times and high-power output. This application not only enhances the overall efficacy and reliability of renewable energy systems but also ensures a consistent energy supply, thereby increasing the demand for ACF in this sector.

Furthermore, the development and commercialization of these advanced energy storage systems can be expedited through strategic partnerships between ACF manufacturers and supercapacitor producers. ACF manufacturers can ensure that ACF-based supercapacitors are optimized for real-world applications by customizing their products to satisfy the specific requirements of the automotive and renewable energy industries through close collaboration with these industries. This opportunity is a critical driver of future market expansion, as evidenced by the increasing adoption of ACF-based supercapacitors in key industries, which is bolstered by ongoing R&D and strategic collaborations.

Higher Production Costs Associated with Manufacturing Hinder Market Growth

The high production costs associated with the manufacture of activated carbon fiber (ACF) are a substantial constraint that could impede the development of the ACF market. Complex processes, such as the carbonization and activation of organic precursors like phenolic resin, polyacrylonitrile (PAN), or cellulose, are involved in the production of ACF. To attain the desirable properties, including mechanical strength, pore size distribution, and high surface area, these processes necessitate precise control of temperature, atmosphere, and time. ACF is more costly than other forms of activated carbon, such as granular or powdered activated carbon, due to the energy-intensive and complex character of these processes. For example, the price of acrylonitrile increased by an average of 20% between 2020 and 2023 as a result of the escalating cost of crude oil and supply chain disruptions. This rise in basic material costs has a cascading effect on the price of ACF, rendering it less competitive in cost-sensitive markets.

The energy-intensive character of the activation process is another factor contributing to the high production costs. The carbonized material is typically heated to temperatures between 800°C and 1,000°C during the activation process, which generates the porous structure in ACF. This process is conducted in the presence of activating substances, such as steam or carbon dioxide. The sustained operation of such high temperatures necessitates a substantial amount of energy, which exacerbates environmental concerns and operational costs. The cost of ACF production is further exacerbated by the global increase in energy prices, which presents a challenge for manufacturers. In certain applications where cost is a critical factor, the adoption of ACF is also restricted by its high production costs. For instance, in large-scale water and air purification systems, the utilization of ACF may be considered economically unfeasible in comparison to less expensive alternatives such as granular activated carbon (GAC).

Expected Future Developments in Activated Carbon Fiber Market

Integration into carbon capture and storage (CCS) technologies is one of the most promising future prospects for the activated carbon fiber (ACF) market. CCS is becoming an essential instrument for mitigating carbon dioxide (CO₂) emissions from industrial sources and power facilities as global initiatives to address climate change intensify. ACF is an essential material in the development of next-generation CCS systems due to its extraordinary adsorption capacity and high surface area, which make it an ideal choice for the capture of CO₂ from flue gases. It is highly effective in the capture of carbon emissions before they are released into the atmosphere due to the efficient adsorption of CO₂ by ACF's microporous structure, even at low concentrations. The chemical stability and resistance to severe conditions that are prevalent in industrial environments further bolster the potential of ACF in CCS applications. Kobe University and Toyobo Co., Ltd., a Japanese institution, executed a comprehensive partnership agreement for research and development in April 2022. With a particular emphasis on environmental research, Kobe University and Toyobo intend to further their collaborative efforts.

This resilience guarantees that ACF-based CCS systems can operate efficiently for extended periods, thereby reducing the necessity for frequent maintenance or material replacement, a substantial cost-saving factor. The increasing emphasis on CCS technologies is a result of global climate objectives, including those delineated in the Paris Agreement, which seeks to restrict global warming to well below 2°C above pre-industrial levels. The capture and storage of nearly 1.5 gigatons of CO₂ annually by 2030 will be necessary to achieve these targets, as per the International Energy Agency (IEA). This considerable opportunity for ACF, which can play a critical role in achieving these ambitious carbon reduction targets, is presented by the increasing demand for effective CCS solutions.

Conclusion

The market for activated carbon fiber (ACF) is expected to experience substantial development in the years ahead, as a result of its integration into cutting-edge technologies, including carbon capture and storage (CCS), supercapacitors, and environmental protection systems. The market's growth is supported by ACF's distinctive characteristics, which include its superior adsorption capacity, high surface area, and chemical stability. These properties render it an ideal material for a variety of high-performance applications. The significance of the ACF market in CCS technologies is one of the most promising growth avenues. The demand for effective carbon capture solutions is anticipated to increase significantly as global efforts to mitigate climate change continue to intensify. Another critical growth opportunity in the energy storage sector is the integration of ACF into supercapacitors. ACF is a critical material in the development of next-generation energy storage devices, particularly for electric vehicles and renewable energy systems, due to its capacity to improve the energy density and power output of supercapacitors.

The Asia-Pacific market, which is responsible for approximately 40% of global ACF consumption, is anticipated to continue to be a dominant force due to accelerated industrialization and stringent environmental regulations. China and Japan are the primary countries promoting the use of ACF in water treatment and pollution control applications. In 2023, China alone accounted for nearly 25% of the global ACF consumption. ACF is anticipated to become more economically viable for a wider range of applications as a result of ongoing advancements in production methods and the exploration of alternative raw materials, despite the challenges of high production costs.

Author's Detail:

Swasti Dharmadhikari /

LinkedIn

Swasti an agile and achievement-focused market researcher with an innate ardor for deciphering the intricacies of the Service & Software sector. Backed by a profound insight into technology trends and consumer dynamics, she has committed herself to meticulously navigating the ever-evolving terrain of digital Services and software solutions.

In her current role, Swasti manages research for service and software category, leading initiatives to uncover market opportunities and enhance competitive positioning. Her strong analytical skills and ability to provide clear, impactful findings have been crucial to her team’s success. With an expertise in market research analysis, She is adept at dissecting complex problems, extracting meaningful insights, and translating them into actionable recommendations, Swasti remains an invaluable asset in the dynamic landscape of market research.