Growing adoption of microgrid controllers for use in military areas is elevating the market growth

The energy market looks for long-term renewable and environmentally friendly alternatives while non-renewable energy resources are being depleted at an alarming rate. Every day, a significant quantity of coal is used by the conventional power generation system to deliver electricity to consumers. As a result, the ecosystem is harmed and global pollution is increased. In addition to the irreparable damage that fuels cause to the environment, fuels are a non-renewable resource, hence it is essential to take renewable resources into account while producing electricity. The availability of energy with great reliability and security is extremely desirable for military applications.

For instance, according to the Professional Journal of U.S. Army, data 2022, in the year 2020, the U.S. Army Futures Command started developing a plan to create electric combat vehicles (ECVs). ECVs offer the advantage of fewer moving parts, improved reliability, and reduced maintenance costs. They also offer instant torque, useful for traversing rough terrain and reduced thermal and acoustic signatures. However, ECVs introduce a new challenge for military electrical systems, an exponential growth in the demand for electrical energy at the forward edge of battle. Thus, supporting the energy demands of these emerging technologies requires a significant modernization and development of the U.S. Army’s microgrids. A microgrid is an independent energy system, which at a minimum consists of electrical generation and distribution assets. The stationary microgrids of the Global War on Terrorism, built on forward operating bases, are not up to the demands of maneuver-centric multi-domain conflicts. This new generation of microgrids must be highly mobile, integrate a diverse array of generation assets and energy storage systems, and employ sophisticated control systems to meet the modern warfighter’s energy demands. Microgrids will provide the mobile electrical power required for DEWs and ECVs to integrate into multi-domain operations.

Today’s mobile command posts, which vary in size and complexity from the battalion to division levels, are microgrids. They are highly mobile electric islands providing electrical energy for communications, planning, operational management, and logistics. In a modern near-peer conflict, these command posts must move every twenty-four hours to ensure their survivability. They typically have one system voltage level (no transformers are used for power transmission) and are powered by one diesel generator. Units often hold an additional generator in reserve, and while technically possible, cooperative generation is extremely rare in practice. Typically, the diesel generators are rated at less than 25 kW, and the microgrids include no energy storage or renewable generation. In their present form, these grids are ill-suited to support the products of the electrification of warfare.

While there is not yet a mature technology to completely rid the U.S. Army of its diesel fuel dependency, modernizing the military electrical microgrids is the pivotal first step to supporting the electrification of warfare. In the short term, intermediate modernization can be accomplished by integrating energy storage systems and adding small photovoltaic generators. This modernization drives the evolution of current command post microgrids into microgrids suitable for the incorporation of directed energy weapons and electric combat vehicles. Therefore, owing to above factors, the demand for microgrid controllers is expected to increase during the forecast period.

Schneider Electric Basic Information, Manufacturing Base, Sales Area, and Competitors

|

Sr. No. |

Item |

Description |

|

1 |

Company Name |

Schneider Electric |

|

2 |

Website |

www.se.com |

|

3 |

Established Date |

1836 |

|

4 |

Headquartered |

France |

|

5 |

Market Position/ History |

Schneider Electric specialized in digital automation and energy management. It was established in 1836 and is headquartered in France. In 1919, the company expanded its business into Germany and Eastern Europe. Further, in 1975, the company acquired an interest in Merlin Gerin, one of the leaders in electrical distribution equipment. In 2004, the company has acquired Clipsal. The Triconex brand was acquired by Schneider Electric in January 2014. Further, in 2016, Schneider acquired Tower Electric, a British company that manufactured fixings and fastenings for construction and electrical firms. |

|

6 |

Sales Area |

Worldwide |

|

7 |

Manufacturing Location |

France and others |

|

8 |

No. of Employees |

More than 168,000 employees (As of year ended December 2023) |

|

9 |

Competitors |

|

|

10 |

CEO |

Peter Herweck |

|

11 |

Ownership Type |

Public |

|

12 |

Ticker |

EPA: SU |

|

13 |

Contact Information |

31 Rue Pierre Mendès France, 38320 Eybens, France Tel: +33 141298500 |

Business Segment/ Overview:

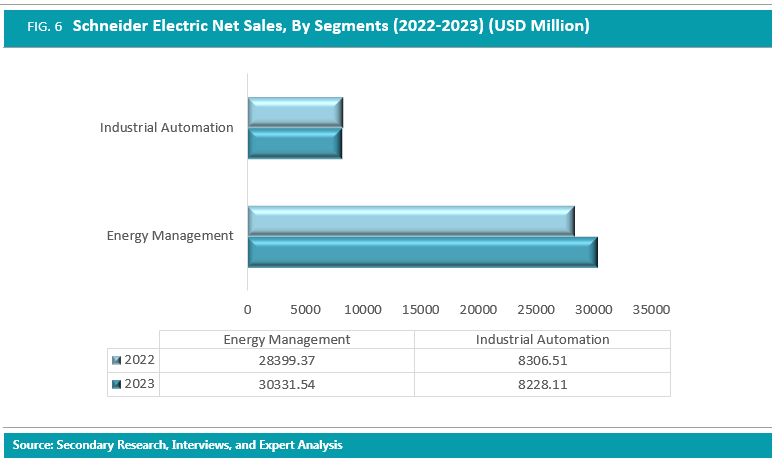

Schneider Electric is a company operating under two segments: Energy Management, and Industrial Automation. Energy Management is sub-segmented into three operating segments: Low Voltage, Medium Voltage, and Secure Power. Industrial automation includes industrial automation and industrial control activities, across discrete, process & hybrid industries.

Products offered by the company are segmented into residential and small businesses, building automation and control, low voltage products and systems, solar and energy storage, medium voltage distribution and grid automation, critical power, cooling and racks, and industrial automation and control.

Residential and Small Business is further classified into electric car charging, electrical protection and control, home automation, home security, installation material, and system, light switches and electrical sockets, and others. Building automation and control segment is classified as building management, controllers, expansion modules, servers & HMIs, energy management software solutions, fire and security, power monitoring and control, and others. Further, Low voltage products and systems are segmented into busway and cable management, circuit breakers, and switches, contactors and protection relays, electrical car charging, electrical protection, and control, energy management software solutions, and others. Similarly, other product segments include different types of products.

Application Industries

• Food & beverages

• Healthcare

• Hotels

• Marine

• Power & Grid

• Semiconductor

• Transportation

• Others

Microgrid Controller Product Types Specification

|

Product |

Description |

|

EcoStruxure Microgrid Operation |

EcoStruxure Microgrid Operation is a control solution for microgrids based on a microgrid controller and SCADA. It promotes the usage of renewable energy and automatically manages the island mode operation in case of abnormal electrical grid conditions. Benefits

Features

|

Investment in Research and Development

Research and development costs incurred and charged to income for the fiscal years ended December 31, 2023 and 2022 were USD 1254.46 million and USD 1116.99 million respectively.

Schneider Electric Net Sales, By Segments (2022-2023)

Schneider Electric Net Sales, By Region (2022-2023)

Recent Developments:

|

Year |

Latest News |

|

April 2024 |

Schneider Electric Released All-In-One Battery Energy Storage System for Microgrids Schneider Electric, one of the significant companies in digital transformation of energy management and automation, launched a Battery Energy Storage System (BESS) designed and engineered to be a part of a flexible, scalable, and highly efficient architecture. BESS is the cornerstone for a fully integrated microgrid solution that is driven by Schneider Electric’s controls, optimization, and world-renowned digital and field services. |

Business Strategy

One of the important elements of the company's operating model is the multi-hub approach, which has been key in Schneider Electric’s strategy over the last years and has particularly demonstrated its benefits since 2020. It has enhanced their network of suppliers and their clients' proximity, agility, and resilience. In 2021, the company's multi-hub strategy was reinforced and strengthened with the creation of the Indian hub, built when merging with Larsen & Toubro’s Electrical & Automation division.

Further, the company has built strong partnerships with customers and suppliers, universities, independent software vendors, technology companies, solution providers, and service providers, to co-design and Share experiences. In addition, the company has invested a significant amount in research and development, to offer innovative and advanced technology-based products to the customer, according to their needs and requirements. The Schneider Electric launched gopact and compact molded case circuit breaker, to expand customer base in the market.

In October, 2021, Schneider Electric, invested its resources on digital transformation of energy management and automation. The company has won the NECA Showstopper Award following the unveiling of its new and improved PowerPac TTM Molded Case Circuit Breaker (MCCB) series at the 2021 NECA Convention Nashville. The rising investment on marketing of product, boost its value and recognition in the market

Moreover, the company is focusing on inorganic development through strategic acquisitions, mergers, and partnerships, to strengthen its product offering and strengthen its foothold in the global market. For instance, the company has acquired Energy Sage company. It is offering intelligent building technologies for real estate, healthcare, hotels, and retail customers, which is increasing its customer base.

S.W.O.T Analysis

Strength

- The company has 183 factories with 94 distribution centers in 50 countries. Thus, wide range of distribution areas across the globe helped the company to establish a robust presence across the globe.

- Strong investment in research and development allowed Schneider Electric to cater to frequently changing customer requirements and cope up with the current trends in microgrid controllers market.

Weakness

- The company might face an issue of high employee turnover rate. For instance, the company has about a total of more than 168,000 employees as of December ended 2023.

Opportunity

- Incorporating new services and new customized products catering to specific requirements of customers might help Schneider Electric to add to their existing customer base.

- Adoption of advanced technologies in its manufacturing facilities is an opportunity for the company to strengthen its position in the global micro grid controller market.

Threats

- Intense competitive pressure faced by other established players in domestic as well as international market is likely to pose threat to company growth.

- Growing adoption of technologies in their manufacturing facilities and new product development process by its competitors might pose threat to overall company growth.